Delaware Judge Blocks Elon Musk's $100B Tesla Pay Package Again

A Delaware court has, once more, put a stop to a truly large pay plan for Elon Musk, the person in charge at Tesla. This decision, which came from a judge in Delaware, means that a compensation deal, now thought to be worth around $100 billion, is not going through. This is a situation that has caught a lot of people's attention, you know, given the sheer size of the money involved.

This particular pay arrangement for Musk, which was first set up in 2018, has been a topic of much discussion for some time. It was designed to give him a big slice of Tesla's future success, but it faced legal challenges from the start. The recent ruling from the Delaware judge just confirms an earlier decision, even after Tesla shareholders had a chance to vote on it again, which is a bit of a twist in the story, as a matter of fact.

So, this latest turn of events means that the legal back-and-forth about this compensation continues. It also shines a light on the unique role Delaware plays in the business world, especially when it comes to how big companies are run and how their leaders are paid. It's a situation that has many layers, and we'll be looking at what it all means, in a way.

Table of Contents

- Who is Elon Musk, and What's the Big Deal About This Pay Package?

- A Look Back - The First Time This Pay Package Was Struck Down

- What Happened with the Shareholder Vote on the Delaware Judge Blocks Elon Musk's $100B Tesla Pay Package Again?

- Why Does This Keep Happening in Delaware?

- The Legal Arguments - Why Did the Delaware Judge Block Elon Musk's $100B Tesla Pay Package Again?

- What's Next for the $100 Billion Pay Package?

- How Does This Affect Tesla and Its Future Plans with the Delaware Judge Blocks Elon Musk's $100B Tesla Pay Package Again?

- What Can We Learn From This Situation Regarding the Delaware Judge Blocks Elon Musk's $100B Tesla Pay Package Again?

Who is Elon Musk, and What's the Big Deal About This Pay Package?

Elon Musk is a person who has made a name for himself in several areas of business. He is known for leading companies like Tesla, which makes electric vehicles, and SpaceX, which focuses on space exploration. He has a history of pushing boundaries and trying to change things in big ways, you know, from how we drive to how we might live on other planets. He is, in some respects, a very public figure, often sharing his thoughts and plans with the world.

His work at Tesla, specifically, has been quite impactful, making electric cars a more common sight on roads around the globe. This has, of course, led to a lot of attention on him and how he is compensated for his work. The pay package in question was set up in 2018. It was designed to reward him if Tesla reached some really big goals, like hitting certain market values and operational milestones. It was a very ambitious plan, potentially giving him a huge amount of stock in the company if all those goals were met, which they basically were.

The deal was structured so that Musk would get stock options in stages as Tesla achieved these significant targets. If all of them were hit, the value of these options would be quite large, eventually growing to what is now considered to be around $100 billion. This kind of compensation is quite rare, and it definitely stood out because of its sheer size and the way it was tied to the company's performance. It was, you know, a plan that really aimed high for both Musk and Tesla.

- Grant Broggi

- Friendly Dental Mooresville

- Meltons App Tap

- Who Is Aishah Hasnie Husband

- Mike Tyson Assless Chaps

Personal Details - Elon Musk

| Full Name | Elon Reeve Musk |

| Nationality | South African, Canadian, American |

| Born | June 28, 1971 |

| Place of Birth | Pretoria, South Africa |

| Known For | Co-founder of PayPal, CEO of SpaceX, CEO of Tesla, Founder of Neuralink, Founder of The Boring Company |

A Look Back - The First Time This Pay Package Was Struck Down

This recent ruling by the Delaware judge is not the first time this specific pay package has been challenged. Back in January 2024, Judge Kathaleen McCormick, who is part of the Delaware Court of Chancery, made an initial decision that put a stop to the compensation plan. She found that the way the package was approved had some issues, basically.

The judge's original reasons for striking down the plan centered on a couple of key points. One major concern was whether the Tesla board members who approved the pay deal were truly independent of Musk. She looked at how close some of the board members were to Musk, and whether they could really make decisions without his influence. It was about making sure that the company's interests, and the interests of all its shareholders, were properly represented, you know, when such a big decision was made. This is a very important part of how companies are supposed to be run.

Another point the judge brought up was about the information given to shareholders before they voted on the package. She felt that the company did not give enough clear details about the plan, or about the process used to create it, so that shareholders could make a fully informed choice. This is, in fact, about transparency and making sure everyone has the full picture. So, her first ruling really questioned the fairness of the process and the independence of those involved in approving the compensation, which, as a matter of fact, is a big deal in corporate law.

What Happened with the Shareholder Vote on the Delaware Judge Blocks Elon Musk's $100B Tesla Pay Package Again?

Following the judge's initial decision to put a stop to the pay package, Tesla decided to put the compensation plan up for a vote again among its shareholders. This happened recently, and the shareholders, in fact, voted to approve the package once more. Many people thought that this new vote by the company's owners might change the judge's mind, or at least give the package a better chance of going through. It seemed, you know, like a clear signal from the people who own the company that they wanted Musk to get this money.

However, Judge McCormick held firm on her earlier ruling. She said that the shareholder vote, while it showed support for the package, did not change the fundamental issues she had found with how the deal was put together in the first place. Her reasoning was that the problems she identified, like the board's independence and the information provided to shareholders, were about the process itself, not just about whether shareholders liked the outcome. So, the vote, basically, did not fix the underlying problems she had pointed out, which is pretty significant.

She made it clear that a vote by shareholders, even a very strong one, cannot simply make past legal issues disappear. The judge's role is to make sure that corporate actions follow the law and are fair to all involved, especially when it comes to how big companies are run and how their top people are paid. So, the recent vote, while important to Tesla and its supporters, did not, in fact, sway the judge from her original legal findings about the package's approval process, which is, you know, a pretty firm stance.

Why Does This Keep Happening in Delaware?

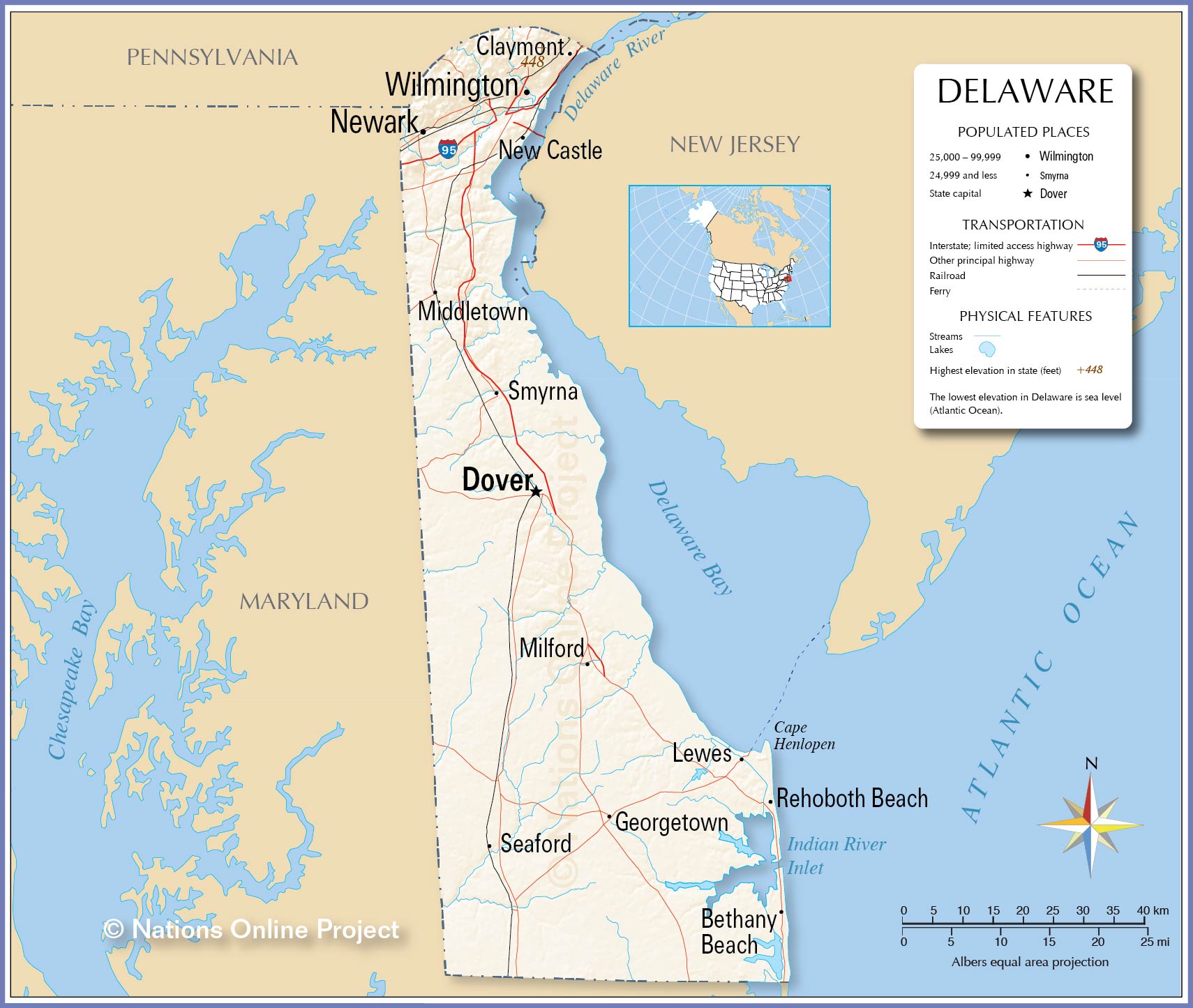

Delaware, a small state in the northeast U.S., has a really big role in the business world. It's sometimes called the "First State" because it was the first colony to accept the new constitution way back in 1787. But for companies, it's known as a place where a huge number of businesses choose to set up their legal home, even if their main operations are somewhere else. You know, it borders Maryland to its south and west, and Pennsylvania to its north. It's a constituent state of the United States of America, and moments of excitement, joy, and relaxation await in Delaware, as a matter of fact.

The main reason so many companies pick Delaware is because of its very developed and specialized corporate laws. The state has a special court, called the Court of Chancery, that handles only business disputes. This court has a long history of dealing with complex company issues, and its judges are known for being very knowledgeable about corporate law. This means that when a business dispute comes up, companies can expect a quick and fair decision from judges who really understand the ins and outs of business operations. It offers, basically, a predictable and well-understood legal environment for companies.

This consistent and expert legal system makes Delaware a very appealing place for companies to incorporate. It gives them a sense of certainty about how legal matters will be handled, especially when it comes to things like shareholder rights, board duties, and executive pay. So, when big cases about company governance or compensation come up, they often land in this specific court in Delaware. It's why we see so many important business rulings coming from this one state, you know, because it's set up to handle these kinds of situations quite well.

The Legal Arguments - Why Did the Delaware Judge Block Elon Musk's $100B Tesla Pay Package Again?

When a judge in Delaware looks at a pay package like the one for Elon Musk, they are really trying to make sure that everything was done fairly and properly. The judge, in this case, Judge McCormick, focused on what are called "fiduciary duties." These are basically the responsibilities that a company's board members have to act in the best interest of the company and its shareholders, not just the CEO or a few individuals. She wanted to know if the board members were truly looking out for everyone's best interests when they approved such a large pay deal, which is, you know, a pretty standard thing for judges to do in these situations.

One of the main points of concern for the judge was whether the negotiations for this pay package were truly "arm's length." This means that the deal should have been negotiated as if the two sides, in this case, Musk and the board, were independent of each other, each trying to get the best deal for their own side. The judge found that the process was not independent enough, basically. She thought that Musk had too much influence over the board members who were supposed to be deciding his pay, which could mean the deal wasn't as fair as it should have been for the company. It's about making sure that there isn't any undue influence in such big decisions, as a matter of fact.

The judge also looked at whether shareholders were given enough information to make a truly informed decision when they first voted on the package. She determined that they were not given all the details they needed to fully understand the implications of the deal, or how it was put together. This lack of full disclosure meant that even if shareholders voted for it, their vote might not have been based on a complete picture. So, the judge's ruling was really about ensuring that the process was sound, that the board acted independently, and that shareholders had all the facts, which is, you know, a very important part of corporate governance.

What's Next for the $100 Billion Pay Package?

So, with the Delaware judge's latest decision, the story of Elon Musk's pay package is far from over. The next step for Musk and Tesla is to take their case to the Delaware Supreme Court. This is the highest court in the state, and it will review the decisions made by Judge McCormick. It's a bit like an appeal, where they try to show that the lower court made a mistake in its legal reasoning. This process can take some time, and there's no guarantee of how it will turn out, you know, as legal battles often have unexpected twists.

Elon Musk himself has been quite vocal about his thoughts on the Delaware legal system following these rulings. He has expressed strong opinions, suggesting that the system is not fair or that it has issues. These comments have added another layer to the public discussion around this case. His legal team has already started the process of appealing the decision, arguing that the judge's original ruling, which rescinded the 2018 compensation, had some errors. They believe that the court should reconsider, especially given the recent shareholder vote, which, as a matter of fact, showed a lot of support for the package.

This appeal will involve both sides presenting their arguments to a panel of judges at the Supreme Court. They will look at the facts of the case, the legal precedents, and whether Judge McCormick applied the law correctly. The outcome of this appeal will be very important, not just for Elon Musk and Tesla, but potentially for how executive compensation is handled in Delaware in the future. It's a situation that everyone involved is watching very closely, you know, to see how it all unfolds.

How Does This Affect Tesla and Its Future Plans with the Delaware Judge Blocks Elon Musk's $100B Tesla Pay Package Again?

This ongoing legal situation around Elon Musk's pay package definitely has some ripple effects for Tesla as a company. For one thing, it keeps the topic of corporate governance in the spotlight. This refers to how a company is directed and controlled, and who makes the big decisions. The judge's rulings have highlighted questions about the independence of Tesla's board of directors and the processes they follow when making important choices, like setting a CEO's pay. This could lead to a closer look at how Tesla's board operates, which is, you know, something that investors and regulators often pay attention to.

Another point to consider is the potential impact on Musk's own focus and his relationship with the company. While he continues to lead Tesla, the ongoing legal battle could be a distraction. It also raises questions about how Tesla will structure future compensation for its top executives, especially for Musk himself. The company might need to come up with new ways to reward its leadership that are more clearly aligned with the judge's expectations for fairness and independent oversight. It's about finding a path forward that satisfies both the need to motivate leaders and the legal requirements for proper corporate behavior, which, as a matter of fact, can be a tricky balance.

The situation could also influence how investors view Tesla. While many shareholders have shown support for Musk, some investors might be concerned about the governance issues raised by the court. The company's stock value is, of course, influenced by many things, but how a company is run and how its leaders are compensated can play a part. So, this ongoing legal challenge, in a way, adds an element of uncertainty that the company will need to manage. It's a really big deal for Tesla, you know, to have this kind of legal challenge hanging over such a significant part of its leader's compensation.

What Can We Learn From This Situation Regarding the Delaware Judge Blocks Elon Musk's $100B Tesla Pay Package Again?

The ongoing legal issues surrounding Elon Musk's pay package offer some useful lessons for companies and their boards, especially when it comes to setting up executive compensation. One of the main takeaways is the absolute importance of board independence. This means that the people on a company's board who are responsible for approving things like CEO pay must be able to make decisions without being overly influenced by the CEO or other powerful figures within the company. It's about having a truly independent group of people looking out for the best interests of all shareholders, which, as a matter of fact, is a core principle of good corporate governance.

Another key lesson is about transparency and making sure that all the necessary information is provided to shareholders. When a company asks its owners to vote on something as big as a CEO's compensation, it needs to give them a complete and clear picture of the deal. This includes details about how the pay package was negotiated, what assumptions were made, and what the potential outcomes could be. Without this full disclosure, a shareholder vote might not hold up in court, as we've seen in this case. It's about ensuring that everyone has the facts they need to make a sensible choice, you know, for the company's future.

This situation also highlights the significant role that courts, particularly the Delaware Court of Chancery, play in overseeing corporate actions. They act as a check and balance, making sure that companies, even very large ones, follow the rules and act fairly. It shows that even if shareholders vote to approve something, a court can still step in if it finds problems with the process or the fairness of the deal itself. So, for any company, it's a reminder that getting a big pay package approved isn't just about getting votes; it's also about making sure the process is legally sound and truly fair from start to finish, which is, you know, a pretty clear message from this case.

Geographical Map of Delaware and Delaware Geographical Maps

Delaware CNA Requirements and State Approved Programs

Reference Maps of Delaware, USA - Nations Online Project